According to the joint report by Morgan Stanley and LuxeConsult, 2023 has been a record year for the Swiss watch industry, with sales reaching 26.7 billion CHF and 16.9 million watches sold (+7.6% compared to 2022).

Private companies continue to outperform holdings, and the top four brands - Rolex, Patek Philippe, Audemars Piguet, and Richard Mille - are strengthening and maintaining their status as the most coveted. Despite a temporary drop in prices in the secondary market, waiting times in boutiques continue to increase, as do the number of pre-orders.

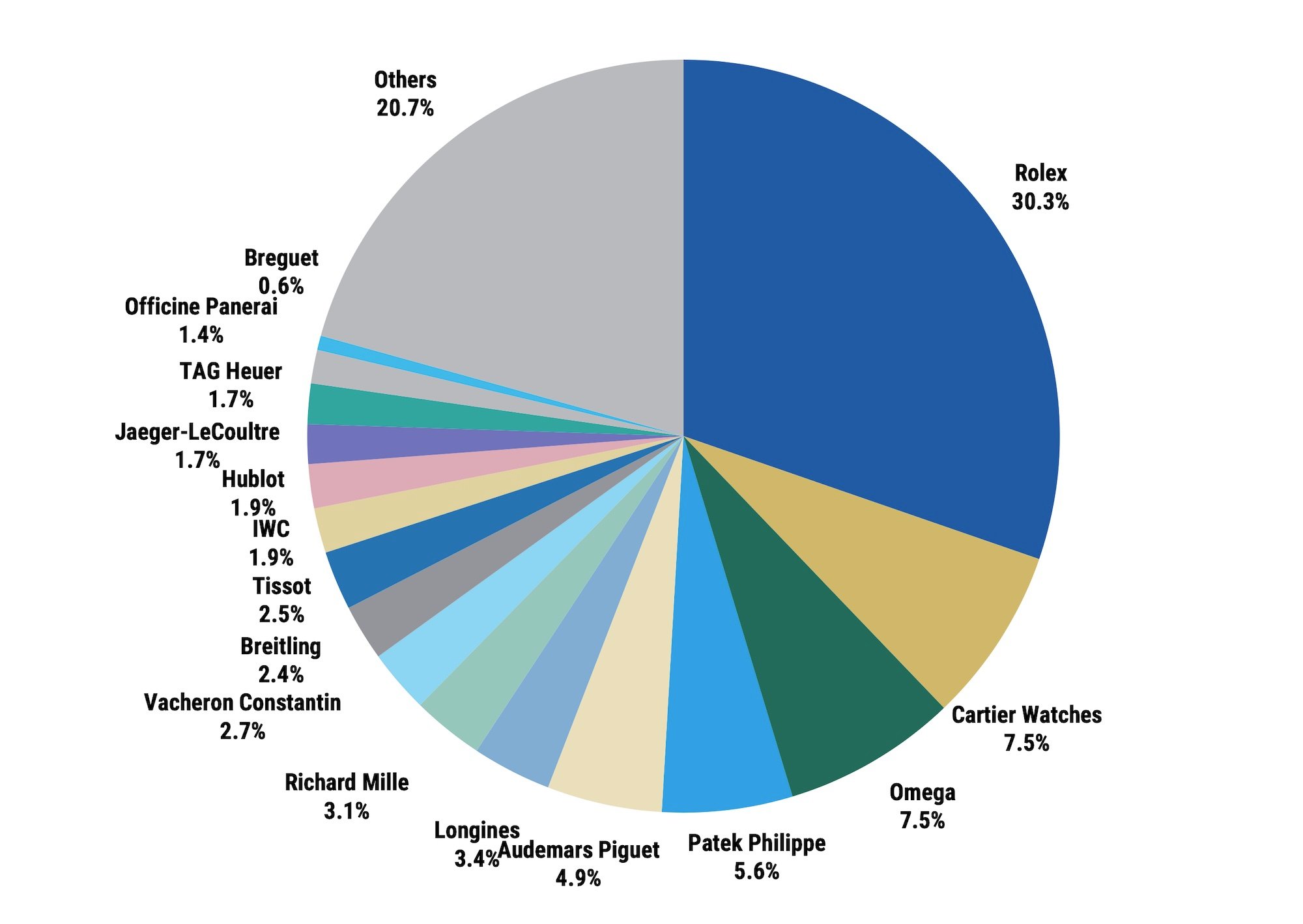

Rolex remains at the forefront of the Swiss watch industry by selling over 1.2 million new watches with a total value exceeding 10 billion Swiss francs, commanding a 30% market share (excluding Tudor(!)).

The entire top five brands (Rolex, Cartier, Omega, Audemars Piguet, and Patek Philippe) showed growth in 2023. Furthermore, four brands (Rolex, Cartier, Omega, and Audemars Piguet) account for over 50% of the total sales in the Swiss watch industry.

Audemars Piguet continues to outpace Patek Philippe in sales volume and average watch price but lags behind in watch quantity and market share.

Vacheron Constantin has also climbed in the rankings, selling around 35,000 watches totaling nearly 1.1 billion CHF.

Swatch Group re-entered the top 20 due to the success of MoonSwatch and collaboration with Blancpain. However, Blancpain itself dropped off the list.

Within the Swatch Group, growth was only seen in the lower price segment (Tissot, Swatch), with Omega remaining stable; the group's other brands did not make it into the top 20.

In the Richemont Group, Cartier, Vacheron Constantin, and A.Lange & Söhne showed excellent results, but IWC and Panerai experienced declines, impacting the overall performance.

Breitling saw a slight increase in monetary value but a decrease in the number of watches sold.

TAG Heuer and Tudor's positions fell, while Longines weakened in China sales. However, the Hermès brand continues to grow. It is worth noting that Longines' market share equals that of Richard Mille (both brands hold a 3% share).

The luxury watch market (with prices exceeding 25,000 CHF) remains the key driver, capturing 69% of the total market growth.