Buying an exclusive Swiss watch is more than just acquiring a luxury accessory — it’s a promising investment. It’s based on a well-calculated strategy that combines a passion for horological masterpieces with asset diversification. Some legendary models today are solid assets with significant investment growth potential.

Key Criteria for Recognizing a Watch as an Investment Asset

Factors to consider when choosing a watch not just as a status symbol or collector’s item, but as a financial asset:

Brand Popularity. This is a key factor, especially when it comes to legendary names such as Rolex, Patek Philippe, Cartier, Audemars Piguet, and Vacheron Constantin. These brands represent top-tier tradition, complications, elegance, and prestige.

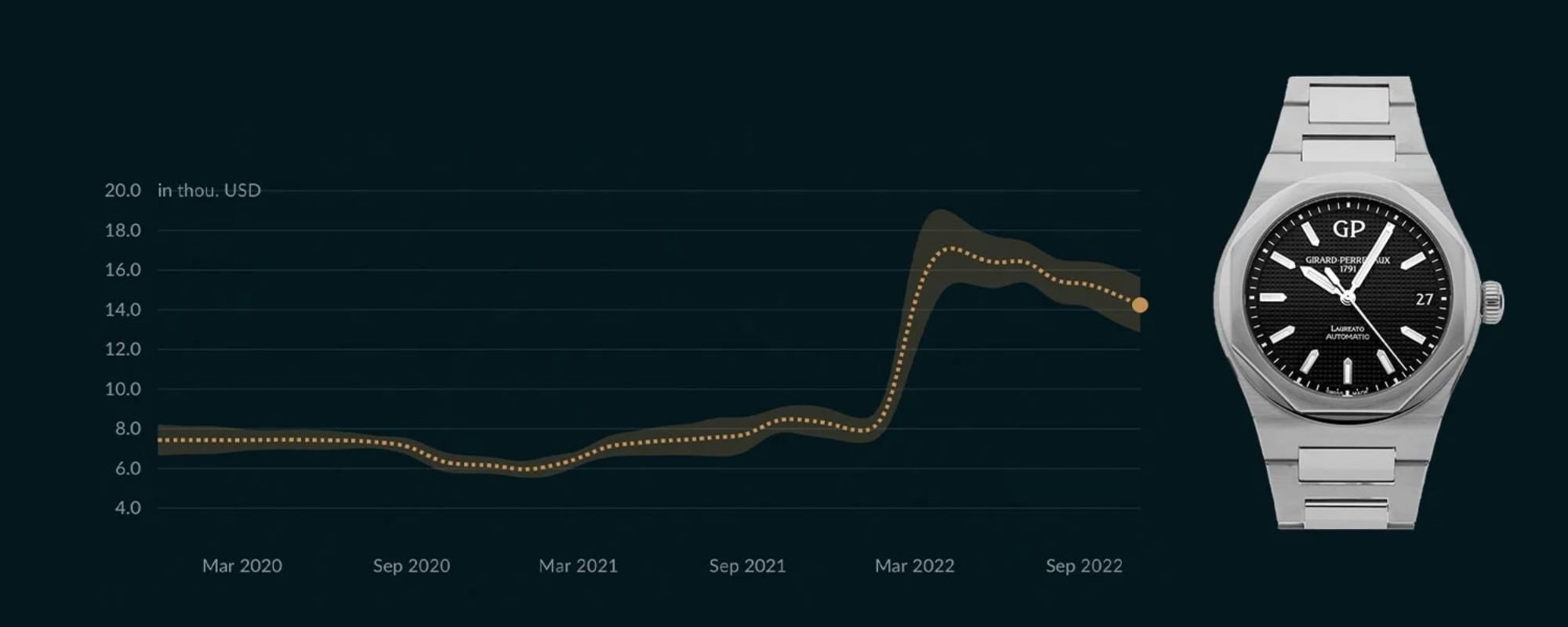

Price Dynamics. As with any investment, the idea is to buy low and sell high. Watches are no exception — track market prices to identify brands or models with genuine potential. Rarity also drives value. For example, that’s why Patek Philippe watches command astronomical prices. To minimize risk, focus on models with stable historical price growth.

Rarity and Demand. It's crucial to understand the production process and the artisan teams behind the watch. For instance, Jaeger LeCoultre assembles teams not just of watchmakers, but also enamel artists, engravers, gem setters, and dial decorators. Rolex can take nine months to produce a simple model, and over two years for more complex ones.

Model History. Watches featured in iconic films, tied to significant events, or worn by celebrities from fashion, show business, or sports increase in prestige and investment appeal.

Many top brands maintain demand on the secondary market by creating artificial scarcity of popular models. Rolex was the first to apply this strategy. The prices of the top 5 Rolex models continue to rise steadily, and collectors are willing to pay premium sums for rare pieces.

📈 Top Investment Watches for 2025

This list is ideal for those looking to start investing in watches within a controlled budget.

Rolex

Models like Submariner, Daytona, and GMT Master have rich histories and tick all the boxes for a smart investment. They’re highly recognizable and symbolize success. Rolex watches are highly liquid globally thanks to their extensive after-sales service network.Audemars Piguet

Royal Oak, Royal Oak Offshore, and Millenary are renowned as luxury steel watches. The Royal Oak 15400STfeatures a unique octagonal case, Grande Tapisserie dial pattern, and an integrated bracelet. For new investors, it offers strong growth potential, while limited availability boosts demand.Patek Philippe

The iconic Nautilus, created by Gérald Genta in 1976, is a classic investment. The most famous version, Nautilus 5711/1A, features a porthole-style blue dial and the refined 26-330 SC caliber. This watch is coveted for its flawless movement and transparent case back, offering a glimpse of its technology. It has become an ultra-desirable asset, especially among newcomers.Omega

The Speedmaster has a legendary place in history, having accompanied the Apollo mission to the Moon. The version featuring Snoopy from the Peanuts comics adds playful charm. The Moonwatch heritage, black dial, tachymeter scale, and collectible appeal make it valuable. Investors are drawn to its limited release, emotional resonance, and steady value growth.Breguet

The Reine de Naples 8928BR/5W/J20DD00 was inspired by a piece created for Napoleon’s sister. During her reign in Naples, she supported the arts, reflected in this model’s design: 18k rose gold, 139 diamonds, and a Tahitian mother-of-pearl dial. From its debut, this watch has been considered a strong investment.

📦 Final Note: When purchasing a watch as an investment, ensure it includes the full set — original box and paperwork. On the secondary market, a complete set commands a significantly higher price.